Updates were published in the Official Gazette of the Federation, [in Spanish: DOF], last December 16, 2020 that amended, added, and repealed various provisions of the Social Security Law and the law of retirement savings systems which focuses on increasing employer contributions, reducing the requirement for qualifying weeks, increasing the amount of the guaranteed pension, and reducing commissions charged by the Retirement Funds Management [in Spanish: AFORE].

A summary of the key amendments is as follows:

1.Reduction of the requirement for qualifying weeks:

- The age of retirement is maintained for those who are 60 years of age due to dismissal and for those over 65.

- The number of qualifying weeks is reduced to 750 for 2021 and increases by 25 weeks each year starting in 2021, totaling 1,000 weeks by 2031.

2. Retirement options

- The insured individual, who has a right to a pension, has the option of choosing between a a life annuity, a planned pension, or both options.

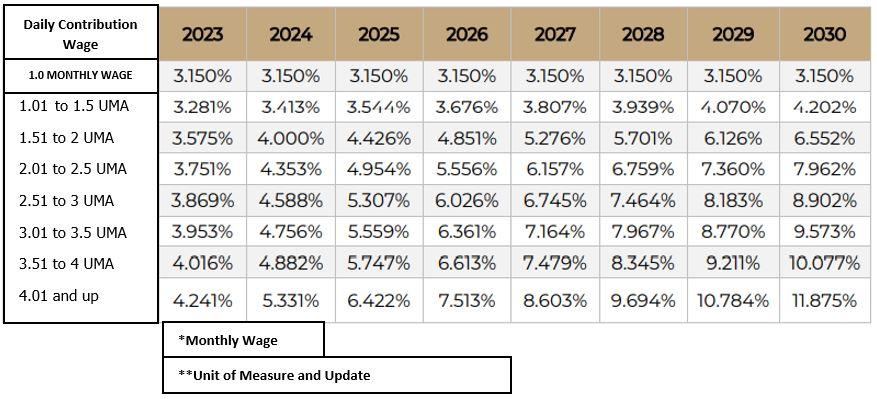

3. A gradual increase in employer contributions according to the daily contribution wage [in Spanish: el salario base de cotización] (SBC).

- Employer contributions, with respect to retirement, will remain unamended: that is, 2% of the daily contribution wage.

- Employer contributions due to dismissal and for those over 65 will gradually increase in accordance with the daily contribution wage of each employee. In 2030 it will increase from 3.150% until it hits a ceiling of 11.875% of the daily contribution wage.

- Employee contributions due to dismissal and for those over 65 will remain at 1.125% of the daily contribution wage, the same as those of the Federal government (0.225% of the daily contribution wage) until December 31, 2022. As of January 1, 2023 it will be eliminated.

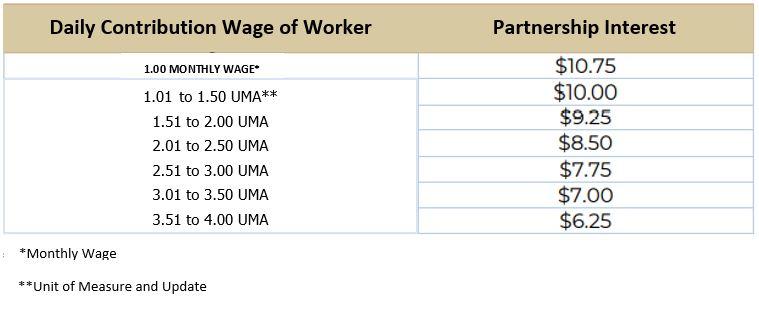

4. Increase and redistribution of partnership interest granted by the government to low-wage workers

- As of January 1, 2023, a partnership interest will be granted to workers that earn up to 4 times the UMA. The amount of the partnership interest will be progressive in nature.

- During the period from January 1, 2021 to December 31, 2022, the partnership interest will be granted in accordance with the law that is in force just before the amendment.

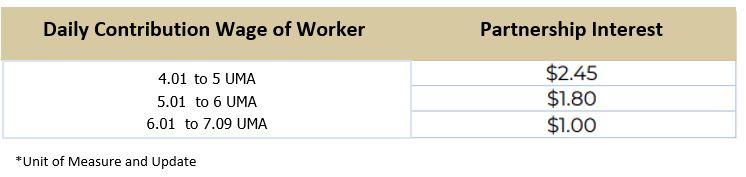

- During the period from January 1 to December 31, 2023, one year, a partnership interest will be granted to workers that earn between 4.01 and 7.09 times the UMA.

5. Amendment to the guaranteed pension (GP)

- The GP will be the minimum amount of pension and will increase from 2,622 to 8,241 pesos. The range will be taken into consideration in order to calculate the amount that is the average of the Daily Contribution Wage earned during one’s career, which will be updated according to the National Consumer Price Index [in Spanish: el Índice Nacional de Precios al Consumidor], (INPC), or the date on which the worker retires, that is; the total number of qualifying weeks and the age at which he/she retires (starting at 60).

6. Changes in commissions charged

- Commissions charged by the Retirement Funds Management, [in Spanish: AFORE], are subject to a maximum limit, which will be an arithmetic mean of the commissions charged by the contribution systems as defined by the United States, Chile, and Colombia.

Please do not hesitate to contact us if you require any further information. Our team will be pleased to assist you: contacto@jadelrio.com