This circular aims to clarify to companies regarding the implementation of Article 21 of Law 2466 of 2025, the Labor Reform. Below, we share some guidelines for implementing this regulation:

Validity

(i) Apprenticeship contracts that were in effect on June 25, 2025, will henceforth be governed by the new Law 2466, but only as of that date.

(ii) Apprenticeship contracts signed from June 25, 2025, are governed entirely by Law 2466.

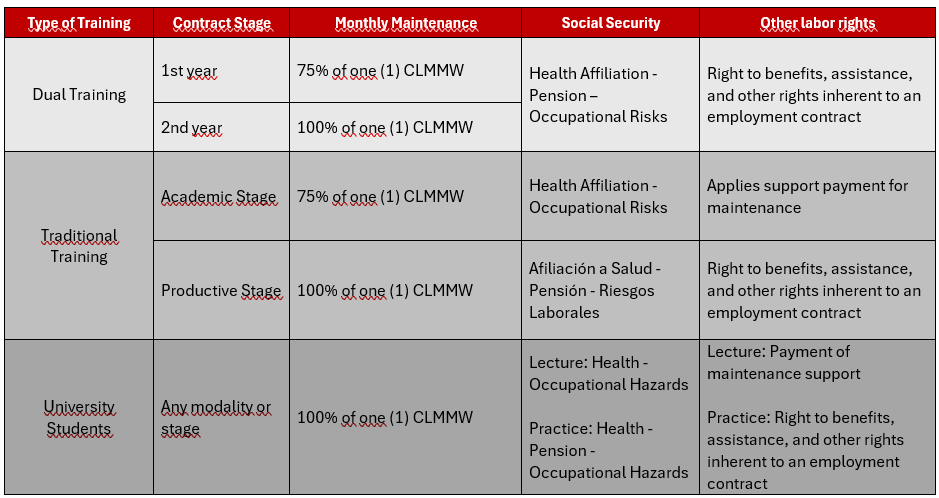

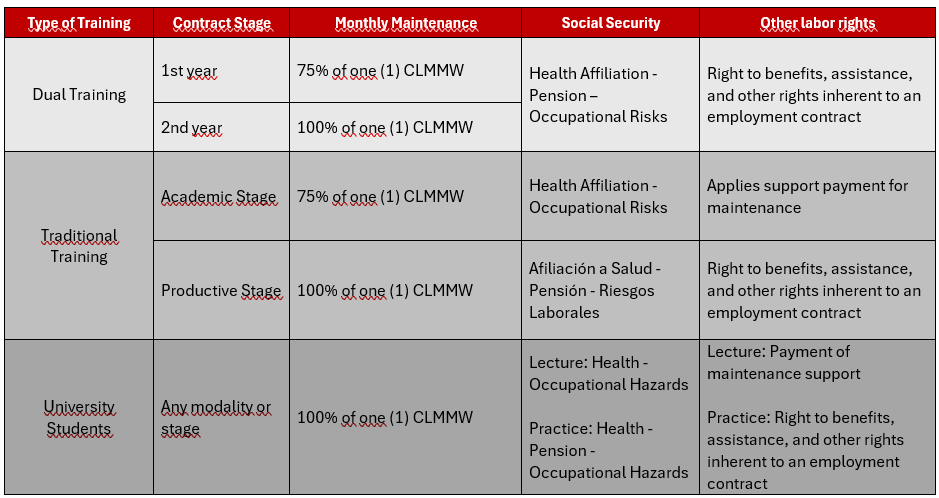

Legal Nature and Payments in the Apprenticeship Contract

(i) The exemption from parafiscal and health contributions provided for in Article 114-1 of the Tax Code applies.

(ii) Supplementary Work must be limited; however, it may be considered highly exceptional in cases where the nature of the training requires it.

(iii) Legal Benefits and Assistance; apprentices in the practical phase will be entitled to recognition and payment of all social benefits, including staffing and transportation assistance and the Family Allowance.

(iv) Payment of Parafiscal Contributions; according to Law 21 of 1982, all dependent workers are required to pay parafiscal contributions unless there is an express legal exemption.

(v) Social security for health, pensions, and occupational risks; during the academic phase, health and risk contributions are the responsibility of the employer; during the practical phase, the following are applicable:

(vi) Unilateral compensation must be paid without just cause, and late payment sanctions must be applied, considering the apprentice's stage.

Apprenticeship Contract Duration and Extensions

(i) The duration of the apprenticeship contract, including any extensions, cannot exceed three (3) years in total.

Apprenticeship Contract Reporting

(i) Apprenticeship contracts will continue to be reported to SENA

(ii) The validation report will also be submitted to the Social Security operator

Payment of contributions to the Comprehensive Social Security System

(i) Educational stage; as of August 1, 2025, in the Integrated contribution settlement form - as its acronym in Spanish, PILA:

- Contributor "1 - Employer”

- Contributor "19 - Apprentice in the productive stage”

- Payroll type "E-employees”

If the health contribution period corresponds to August 2025.

(ii) Productive stage and dual training; Starting August 1, 2025, in the Integrated contribution settlement form - as its acronym in Spanish, PILA:

- Contributor "1-employer”

- Contributor "1-dependent”

- Payroll type "E-employees”

If the health contribution period corresponds to August 2025.

(iii) The Ministry of Health and Social Protection is working on an administrative act, under which it will report the adjustments to social security operators to comply with this Law.

(iv)The "Exempt from employer contributions to health, SENA, and ICBF" field must be reported as appropriate.

The content of this newsletter is merely informative, that´s why it cannot be used under any circumstances as advice on the matter described in it. If you need advice on any of the aspects discussed, our team of professionals will be willing to assist you. contacto@jadelrio.com