The 2026 fiscal year brings with it a series of significant changes that directly impact the tax situation of individuals. These changes respond to regulatory adjustments, updates to tax criteria, and new provisions aimed at strengthening tax collection and simplifying compliance with obligations.

Below is a list of the most relevant changes applicable as of January 1, 2026:

1. Increase in the monthly rate of late payment surcharges

Rule 2.1.20 Periodic Amendments to the Tax Law for 2026 [in Spanish: RMF]

For the 2026 fiscal year, the tax authority establishes a new monthly late payment surcharge rate of:

This percentage represents a significant increase over the rate in effect in 2025 (1.47% per month). Therefore, special attention is recommended for the timely payment of taxes in order to avoid additional financial costs.

2. Restriction on the use of passwords for Income Tax refunds

2.3.2 Periodic Amendments to the Tax Law, (RMF), for 2026

For the filing of the annual return for the immediately preceding fiscal year (2025), and in the event of a credit balance, the following requirements must be met for it to be considered within the Automatic Refund System:

- Any income tax credit balance greater than $10,000.00 MXN must be submitted using an electronic signature or portable signature.

- The Income Tax credit balance must not exceed $150,000.00 MXN.

This limitation applies even when a bank account, (18-digit CLABE or Standardized Bank Code), preloaded on the portal is selected.

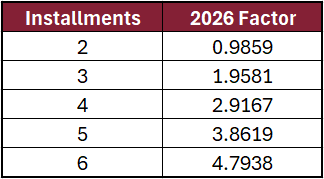

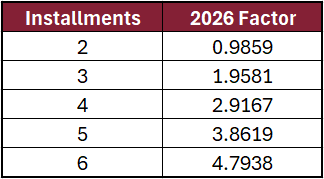

3. Update of factors for payment in installments of annual Income Tax

Rule 3.17.3 Periodic Amendments to the 2026 Tax Law, (RMF), for 2026

The authority once again grants the option of paying the annual Income Tax for the 2025 fiscal year in up to six monthly installments. The following applicable factors are posted as follows:

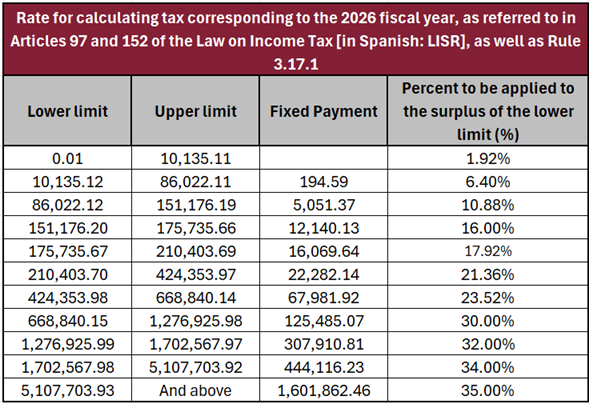

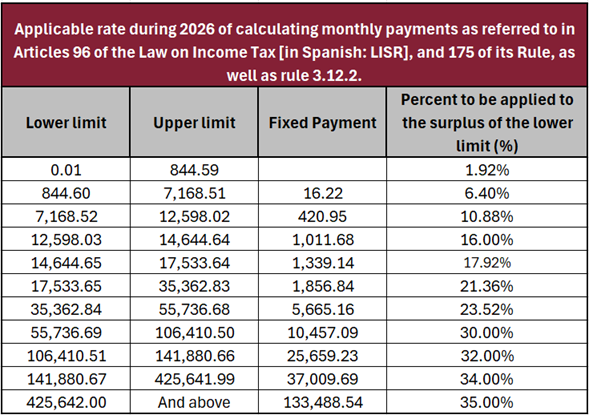

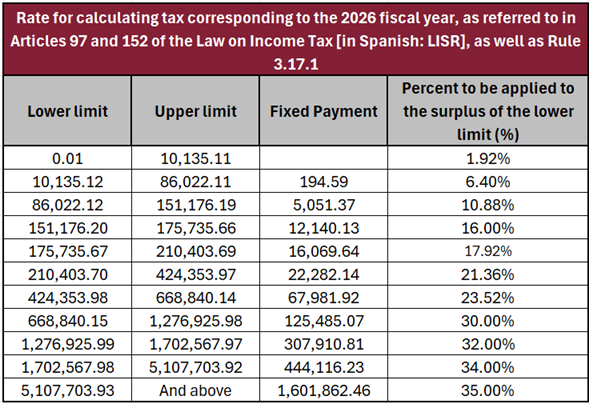

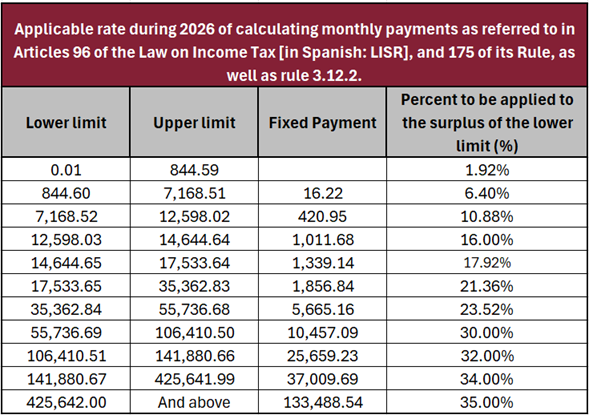

4. Adjustment in Income Tax rates

Annex 8 – Rates applicable to provisional payments, withholdings, and Income Tax calculation

Since cumulative inflation in 2025 exceeded 10%, the Ministry of Finance and Public Credit, [in Spanish: SHCP], announced the new rates for calculating Income Tax for individuals, which apply as of January 1, 2026.

Some of the new applicable rates are:

- Calculation of annual Income Tax

- Monthly Income Tax payments

5. Increase in the withholding rate applicable to digital platforms for 2026

Article 25, Section VI of the 2026 Federal Revenue Law

In accordance with the provisions of Article 25, Section VI, of the Federal Revenue Law for the 2026 fiscal year, the withholding rate applicable to individuals who obtain income from the disposal of assets and the provision of services through digital platforms is modified.

For the 2026 fiscal year, the corresponding withholding will be 2.5%, which represents an increase from the 1% in effect during the 2025 fiscal year.

6. Deferral of the deadline for activating the tax mailbox and updating contact details

Provisional Article 4 of the Periodic Amendments to the Tax Law (RMF)

In accordance with Provisional Article 4 of the Periodic Amendments to the Tax Law, (RMF), taxpayers who have not enabled their Tax Mailbox or who have not registered or updated their contact details will be subject to the penalty provided for in Article 86-D of the Federal Tax Code as of January 1, 2027.

Consequently, taxpayers have until that date to comply with the obligations relating to the activation of the Tax Mailbox and the registration or updating of their contact details, without any penalty being imposed.

7. Increase in the Income Tax withholding rate for credit institutions or brokerage firms in securities lending transactions relating to shares or stocks

3.16.12 Periodic Amendments to the Tax Law (RMF) for 2026 and Article 25, Section X of the 2026 Federal Revenue Law

In accordance with the provisions of Article 25, Section X, of the Federal Revenue Law for the 2026 fiscal year, the withholding rate applied by credit institutions to interest payments is modified.

For the 2026 fiscal year, the corresponding withholding will be 9% on nominal interest, which represents an increase from the 5% in effect during the 2025 fiscal year.

8. Increase in the General Minimum Wage

National Minimum Wage Commission

It was determined that, as of January 1, 2026, the general minimum wage will increase compared to 2025 as follows:

- By 13.0% in the General Zone Minimum Wage [in Spanish: ZSMG], raising it to 315.04 pesos per day of work.

- By 5.0% in the Northern Border Free Zone [in Spanish: ZLFN], raising it to 440.87 pesos per day of work.

The tax changes for 2026 reflect greater control by the authorities, significant adjustments in financial costs, and an administrative reorganization of tax procedures. We recommend reviewing these provisions in a timely manner to ensure proper compliance with tax obligations and adequate tax planning.

J.A. DEL RÍO offers a wide array of specialized consulting services to assist you with these and other matters, in order to ensure that your project complies with the applicable characteristics contained in this agreement.

If you have any questions, J.A. DEL RÍO can provide you with our experts to advise in matters concerning compliance with your legal and tax obligations. Once again, please let us know if we may be of any further assistance to you at: contacto@jadelrio.com.